Liquidations Facet (0.8.4)

Last updated

Last updated

The Liquidations Facet enables authorized liquidators to intervene when a party’s available balance falls below required thresholds. Liquidation actions include:

Liquidating Party A or Party B positions

Setting symbol prices at liquidation time

Processing deferred liquidations

Liquidating pending positions

Settling and resolving liquidation disputes

In order to grasp the intricacies of the liquidation process, a fundamental understanding of the 'pending locked' concept is crucial. When a user sends a quote request, the corresponding amount of the position goes into a 'pending' state. During this phase, the user is restricted from opening other positions with that specific amount. Nonetheless, this amount continues to contribute to the user's allocated funds when assessing their liquidity status. Once Party B opens the position, this amount goes from the 'pending' to the 'locked' state.

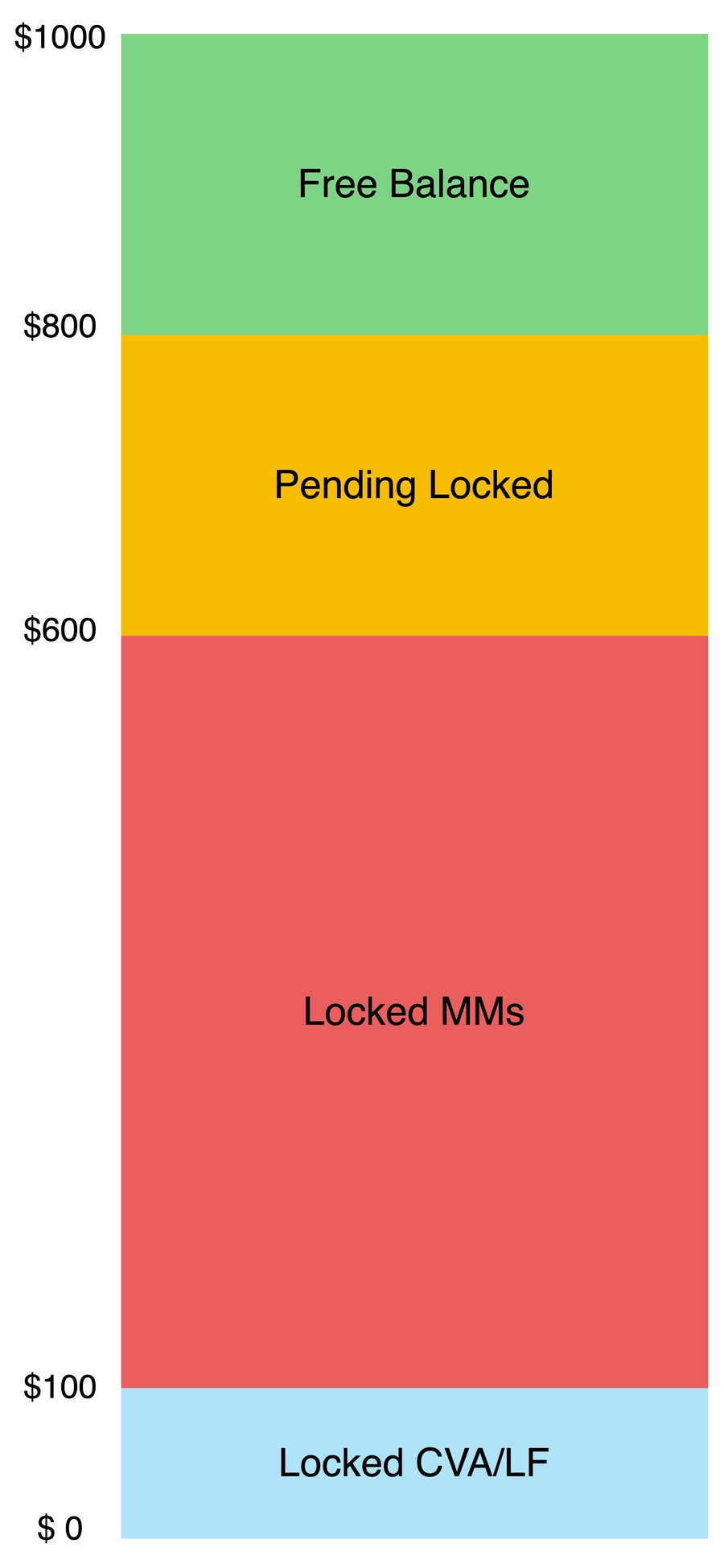

For a better understanding of how a user gets liquidated, let’s look at one with a $1000 allocated balance as an example:

User positions are all considered to be cross, meaning that in the above picture, values can be the sum of the equivalent values in 4 different positions. Pending locked values are from user quotes that have not been opened yet.

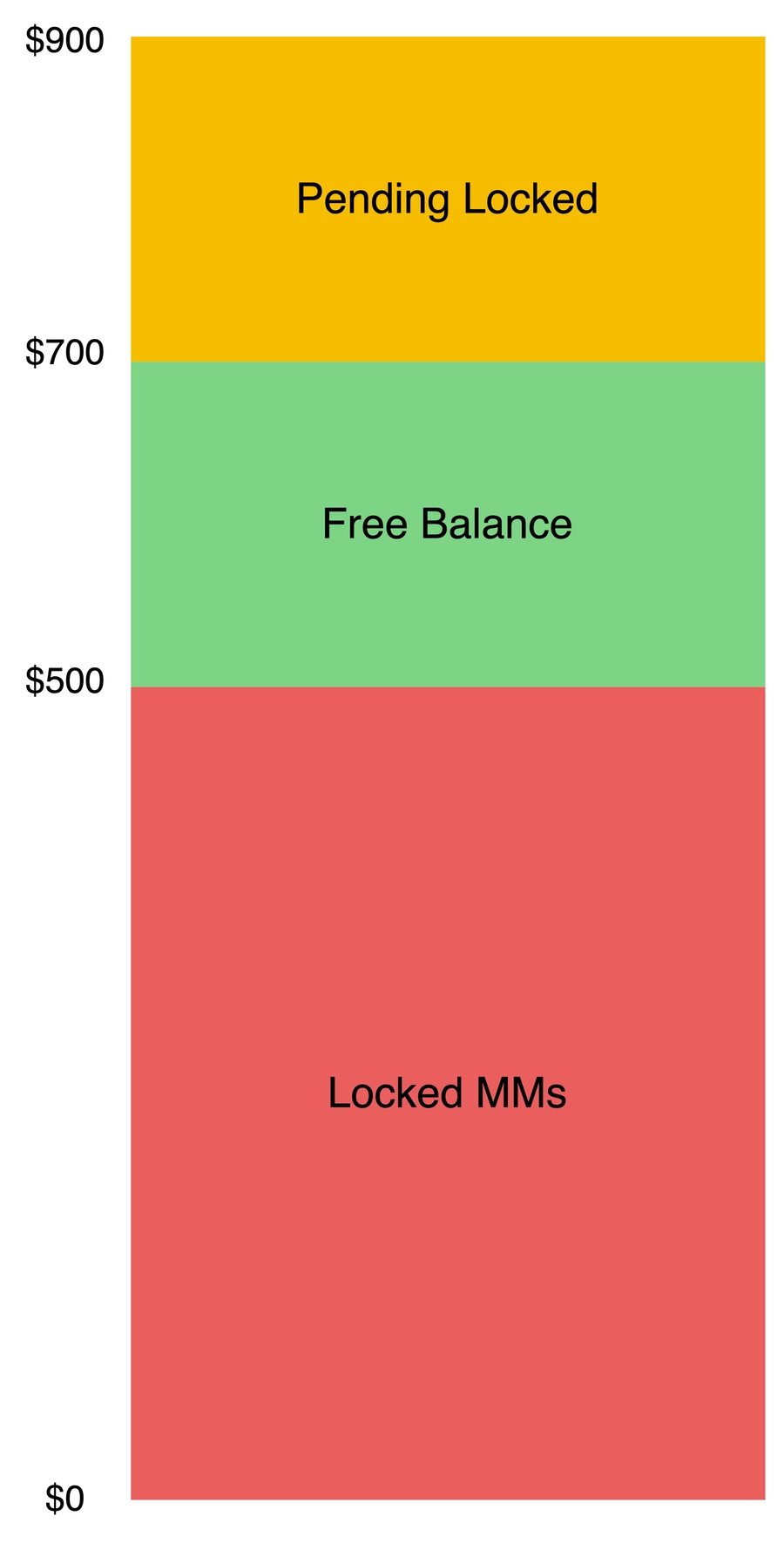

Now let’s say that the user is having a bad day, and one of their positions is sinking deep into loss:

Each user position has a respective UPNL, which determines whether the position is in profit(positive UPNL) or loss(negative UPNL). Adding all those UPNLs, we get the user’s total UPNL. Now let’s see what happens if UPNL changes:

Total upnl > 0: User is overall in profit

-500 < Total UPNL < 0: User’s locked MMs are supporting their positions

-700 < Total UPNL < -500: User’s free balance is now supporting their positions

-900 < Total UPNL < -700: User’s pending locked values are supporting their position

Total UPNL < -900: User will be liquidated now

As this is a cross-system, whenever a user gets liquidated, all of their quotes and positions will go to a liquidated state, or in other words they all get canceled.

On the contract side, the liquidation of partyA is a four-step process. The liquidator should first liquidate the user:

At this point the user is marked as liquidated and the timestamp for that is recorded.

Then the liquidator should set the prices for all symbols associated with the user's positions:

Then the liquidator should liquidate partyA pending positions:

And after that the liquidator should liquidate partyA open positions:

Liquidates Party A when their available balance falls below the required threshold. This function verifies a Muon signature (contained in a LiquidationSig struct) and, upon successful verification, marks Party A as liquidated, updates their liquidation details, and records the liquidator.

Function Signature:

Parameters:

partyA: Address of the Party A to be liquidated.

liquidationSig: A structure containing:

upnl: Unrealized profit and loss.

totalUnrealizedLoss: Total loss incurred.

liquidationId: Unique identifier for the liquidation.

timestamp: Signature timestamp, among other fields.

Example Usage:

Events Emitted:

LiquidatePartyA(address liquidator, address partyA, uint256 allocatedBalance, int256 upnl, int256 totalUnrealizedLoss, bytes liquidationId)

(A backward compatibility version is also emitted without the liquidationId.)

Updates the prices for all relevant symbols at the time of liquidation. The provided LiquidationSig includes arrays of symbol IDs and prices, which are stored along with the liquidation timestamp.

Function Signature:

Parameters:

partyA: Address of Party A for which the symbol prices are being set.

liquidationSig: A liquidation signature containing:

Example Usage:

Events Emitted:

SetSymbolsPrices(address liquidator, address partyA, uint256[] symbolIds, uint256[] prices, bytes liquidationId)

(A backward compatibility version is also emitted.)

Processes a deferred liquidation for Party A using a DeferredLiquidationSig.

Previously, the upnlValidTime variable in the Muon configuration prevented the liquidator from liquidating a user after a certain amount of time. This update allows the liquidator to liquidate the user if they haven't increased their nonce, provided the Muon app can supply signatures for a specific block requested by the liquidator. The LiquidationSig struct has been updated accordingly:

Function Signature:

Parameters:

partyA: Address of the Party A to be liquidated.

liquidationSig: A deferred liquidation signature struct.

DeferredLiquidationSig Struct:

Example Usage:

Events Emitted:

DeferredLiquidatePartyA(address liquidator, address partyA, uint256 allocatedBalance, int256 upnl, int256 totalUnrealizedLoss, bytes liquidationId, uint256 liquidationBlockNumber, uint256 liquidationTimestamp, uint256 liquidationAllocatedBalance)

Sets the symbol prices in a deferred liquidation scenario using a DeferredLiquidationSig. Functionally similar to setSymbolsPrice, but for deferred liquidations.

Function Signature:

Parameters:

partyA: Address of Party A.

liquidationSig: Contains symbol IDs, prices, and a liquidation identifier from the deferred liquidation process.

DeferredLiquidationSig Struct:

Example Usage:

Events Emitted:

SetSymbolsPrices(address liquidator, address partyA, uint256[] symbolIds, uint256[] prices, bytes liquidationId)

(Also emitted for backward compatibility.)

Liquidates all pending quotes (i.e., those not yet fully executed) for Party A. This function processes each pending quote, updates their status to a liquidation state, and clears associated locked balances.

Function Signature:

Parameters:

partyA: Address of Party A whose pending positions will be liquidated.

Example Usage:

Events Emitted:

LiquidatePendingPositionsPartyA(address liquidator, address partyA, uint256[] pendingQuoteIds, uint256[] liquidatedAmounts, bytes liquidationId)

(Also emitted for backward compatibility.)

Liquidates specific open positions for Party A, as identified by an array of quote IDs. This function processes each quote by updating its status to "LIQUIDATED".

Function Signature:

Parameters:

partyA: Address of Party A whose positions are to be liquidated.

quoteIds: Array of quote IDs representing the positions to be liquidated.

Example Usage:

Events Emitted:

LiquidatePositionsPartyA(address liquidator, address partyA, uint256[] quoteIds, uint256[] liquidatedAmounts, uint256[] closeIds, bytes liquidationId)

(Backward compatibility event is also emitted.)

If the liquidation is disputed, the events:

LiquidationDisputed(address partyA, bytes liquidationId)

(Also a backward compatibility version) are emitted.

Settles the liquidation process for Party A by reconciling settlement amounts with one or more Party Bs. After processing, if Party A is fully liquidated, the function emits events to signal completion.

Function Signature:

Parameters:

partyA: Address of Party A.

partyBs: Array of Party B addresses involved in the liquidation settlement.

Example Usage:

Events Emitted:

SettlePartyALiquidation(address partyA, address[] partyBs, int256[] settleAmounts, bytes liquidationId)

(Also emits a backward compatibility event.)

If Party A becomes fully liquidated, the events:

FullyLiquidatedPartyA(address partyA, bytes liquidationId)

(And a backward compatibility version) are emitted.

Resolves a dispute arising from a liquidation process for Party A. Settlement amounts for each involved Party B are updated, and the dispute status is recorded.

Function Signature:

Parameters:

partyA: Address of Party A.

partyBs: Array of Party B addresses involved in the dispute.

amounts: Array of settlement amounts corresponding to each Party B.

disputed: Boolean flag indicating whether the liquidation is disputed.

Example Usage:

Events Emitted:

ResolveLiquidationDispute(address partyA, address[] partyBs, int256[] amounts, bool disputed, bytes liquidationId)

(And a backward compatibility event.)

Description: Liquidates Party B with respect to a specific Party A by verifying a UPnL signature. This function is used when Party B’s allocated balance is insufficient, and it updates Party B’s liquidation status.

Function Signature:

Parameters:

partyB: Address of the Party B to be liquidated.

partyA: The associated Party A address.

upnlSig: A structure containing UPnL signature data for Party B.

Example Usage:

Events Emitted:

LiquidatePartyB(address liquidator, address partyB, address partyA, uint256 allocatedBalance, int256 upnl)

Liquidates open positions for Party B (with respect to a specific Party A) using a QuotePriceSig. This function processes an array of quote IDs, updates each quote’s status to LIQUIDATED, and adjusts balances accordingly. If Party B has no remaining positions after liquidation, a fully liquidated event is emitted.

Function Signature:

Parameters:

partyB: Address of Party B whose positions are to be liquidated.

partyA: Associated Party A address.

priceSig: A structure containing:

quoteIds: An array of quote IDs.

prices: An array of corresponding prices.

timestamp: The signature timestamp for verification.

Example Usage:

Events Emitted:

LiquidatePositionsPartyB(address liquidator, address partyB, address partyA, uint256[] quoteIds, uint256[] liquidatedAmounts, uint256[] closeIds)

(A backward compatibility event is also emitted.)

If Party B’s positions are fully liquidated, the event:

FullyLiquidatedPartyB(address partyB, address partyA) is emitted.